Institutional-grade convexity analytics distilled, democratized, engineered for edge.

“Professional-grade anomaly telemetry — a persistence-aware convexity detector, not a toy UOA feed.”

— Institutional Volatility Desk, early beta user

ConvexityIQ transforms academic insight into executable edge. Options reprice before equities, embedding asymmetric information in volatility surfaces. These convexity shifts are real — and they decay quickly as markets absorb them.

Our engine captures those repricing events across horizons, filters noise, and isolates persistence. The result: verified convexity anomalies delivered before decay — signals that can be sized, risk-gated, and executed.

By converting raw option telemetry into structured buy-zone intelligence, ConvexityIQ bridges quant research and practical execution — making institutional-grade convexity insight accessible to everyone.

Alpha, Systematized

Signal Science

- Convexity-First Analytics: Detects when options have already repriced — capturing edge before stocks catch up.

- Mispricing Fingerprints: Identifies rare, persistent dislocations instead of short-lived noise.

- Pre-Catalyst Signals: Surfaces contracts that move ahead of news and events.

Execution & Risk

- Capacity-Proof Edge: Targets smaller setups where large institutions can’t easily participate.

- Regime-Aware Risk Gating: Stress-tests signals against volatility, yields, liquidity, and crypto sentiment.

- Auto-Execution Tilts: Adapts allocations in real time with disciplined, slippage-aware execution.

Meta-Structure

- Transparent Scorecards: Every signal carries its horizon, decay profile, and persistence rank.

- Noise-to-Signal: Filters out false positives — only durable anomalies make it through.

- Continuous Learning: Feedback loops refine models and allocations as markets evolve.

The Problem → The Solution

1. The Legacy Model — Reactive Convexity (After the Fact)

The legacy workflow monitors implied-vol surfaces, skew ratios, and tape-confirmed option prints.

UOA feeds and dealer flow monitors are post-event telemetry — they report the distortion after it has hit the tape.

What it sees

- Large prints and one-off sweeps

- Skew kinks and surface jumps

- End-of-day anomalies on already-repriced chains

What it misses

- Early curvature shifts across expiries (pre-tape)

- Persistence / decay profile of the anomaly

- Cross-horizon coherence (5/10/20 windows)

Operational consequences

- Alpha is engaged after repricing → reduced edge and higher slippage.

- Flow signals are noisy (single-candle bursts) → low hit rate without persistence gating.

- Risk can’t size correctly → no half-life, no monetization horizon.

It’s rain-watching, not weather-mapping — observing the downpour instead of the pressure systems forming behind it.

2. The Breakthrough — Proactive Convexity Intelligence (Before the Tape)

Instead of reacting to realized prints, Proactive Convexity Intelligence continuously ingests cross-horizon data, models realized ROI persistence, and detects where convexity is already re-pricing — in real time, before the street recognizes it.

| Dimension | Reactive Convexity | Proactive Convexity Intelligence |

|---|---|---|

| Trigger | Volume spikes, skew shifts | Multi-window convexity repricing trend |

| Timing | Post-factum | Real-time / pre-catalyst |

| Objective | Detect anomalies | Detect persistent asymmetries |

| Signal life | Momentary | Modeled via α½-life |

| Actionability | Low (after the move) | High (before decay) |

| Primary Instrumentation | UOA feed, vol chart | ConvexityIQ engine |

This is the leap from watching rainfall to reading the pressure gradients that forecast the storm. ConvexityIQ measures those gradients — the curvature shifts that precede visible market moves.

3. The Edge — Forecasting Convexity Before It Forms

Markets are convexity ecosystems. Deltas and vegas compound non-linearly — convexity dictates flow. Detecting early-stage repricing allows positioning before the volatility regime shift — an edge that propagates through trading, hedging, and portfolio construction.

- Anticipate and front-run hedging flows before they cascade.

- Price skew and volatility supply with precision.

- Harvest short-lived convex asymmetries before decay.

ConvexityIQ converts raw option flow into Proactive Convexity Intelligence — continuous market telemetry that surfaces where optionality is being re-valued before the market fully adjusts.

ConvexityIQ isn’t a signal feed — it’s volatility’s weather radar: infrastructure for forecasting convex asymmetry before it hits the tape.

How ConvexityIQ Works

We scan global markets for unusual patterns in options, flows, and macro data — surfacing signals that others miss.

Every signal is filtered through risk checks so that only high-probability setups get through.

Capital is distributed dynamically across growth, defensive, and hedge sleeves — ensuring balance across regimes.

Algorithms enter and exit positions efficiently, adapting to shifting market conditions in real time.

A continuous feedback loop refines models, while the AI copilot clusters signals into themes and generates narrative insights.

Why it matters: ConvexityIQ turns raw dislocations into disciplined trades. Signals are captured before they decay, filtered by risk, and converted into allocations that adapt as markets evolve.

Velocity Surfaces

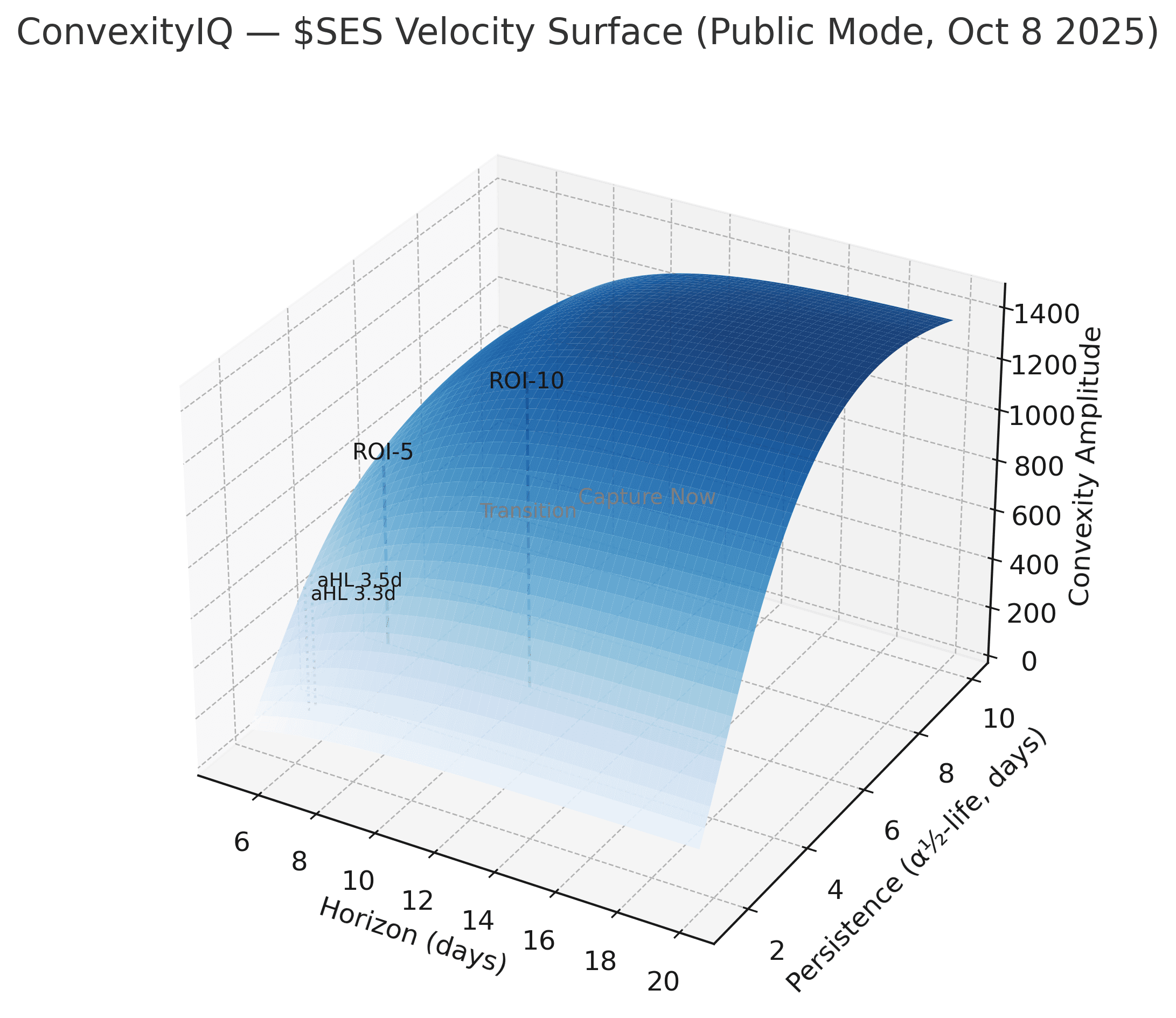

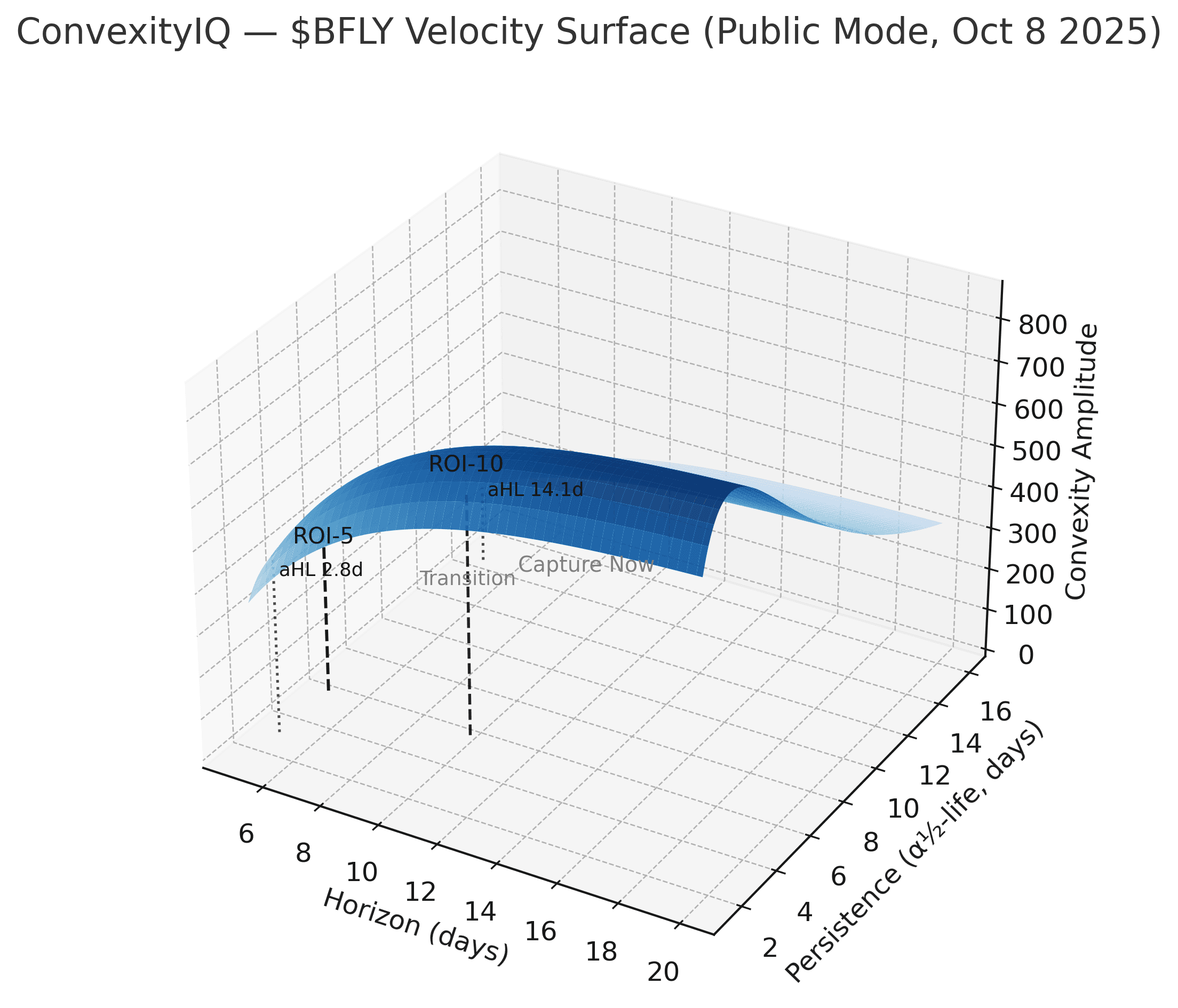

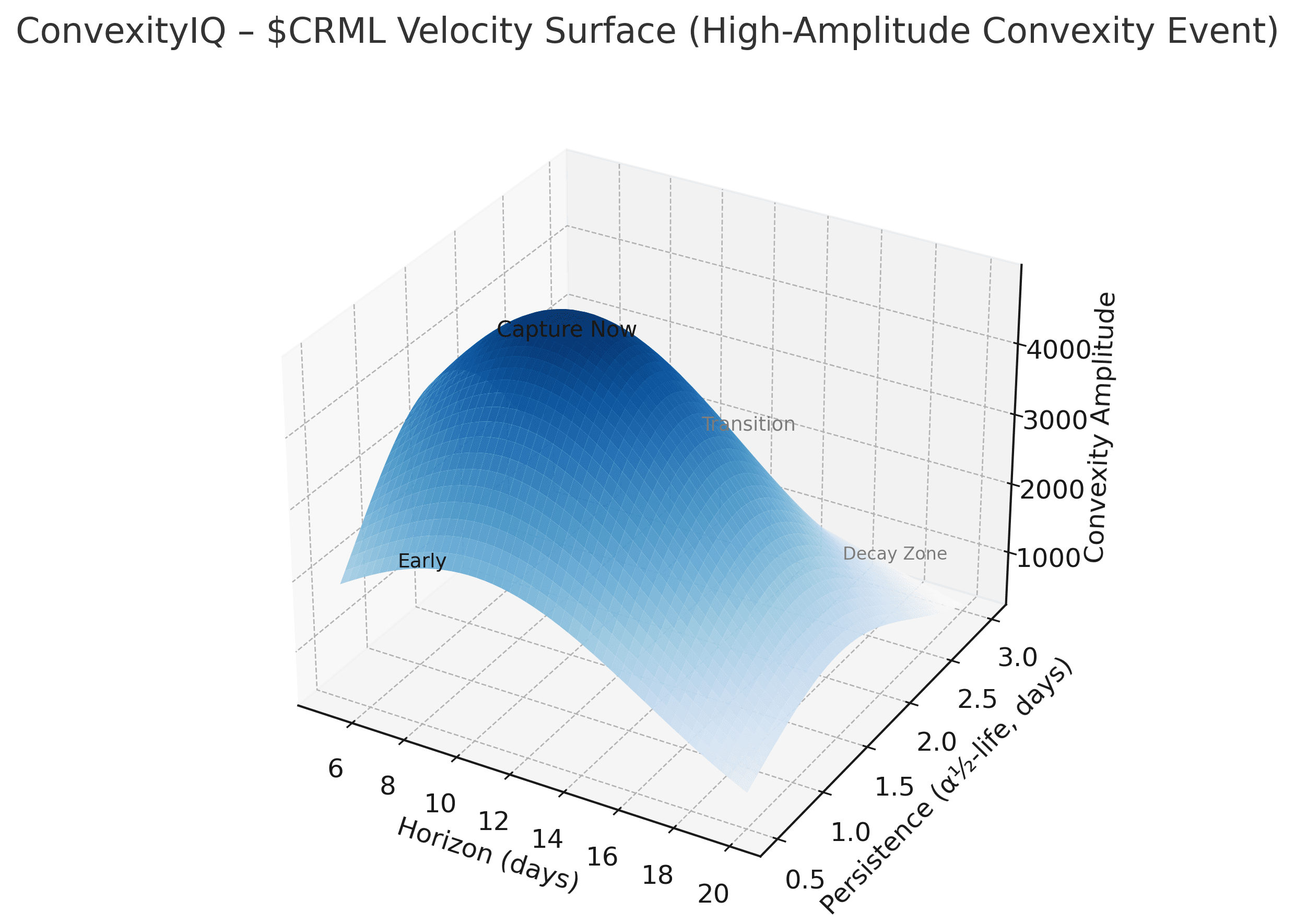

Survivors from our risk gating are rendered as Velocity Surfaces — 3D maps of convexity amplitude by time horizon and persistence (α-half-life). These make the monetization window visible: Early → Transition → Capture Now → Decay.

Mathematical Foundations

ConvexityIQ is built on well-established principles of calculus and convex analysis. The foundations appear in standard treatments of higher-order change and curvature.

Higher-Order Change

The first level of change measures slope — the rate at which a function rises or falls. The second level measures curvature — how the slope itself is changing. A function that curves upward is considered convex; one that curves downward is concave. These curvature properties determine how a function bends, whether it “holds water” or “spills water,” and where turning points occur.

Convexity in Options

Options have inherently nonlinear payoffs, so their value does not move in a straight line with the underlying asset. They are sensitive not only to immediate price changes but also to changes in curvature. Traditional Greeks (delta, gamma, vega) describe these sensitivities, yet they are static snapshots and often miss how convexity repricing unfolds over time.

Inflection and Discontinuity

Just as mathematical functions can change convexity at turning points or show discontinuities, option markets frequently exhibit sharp shifts in curvature driven by order-flow shocks, catalysts, or liquidity imbalances. These moments of sudden change are the fingerprints of anomalies.

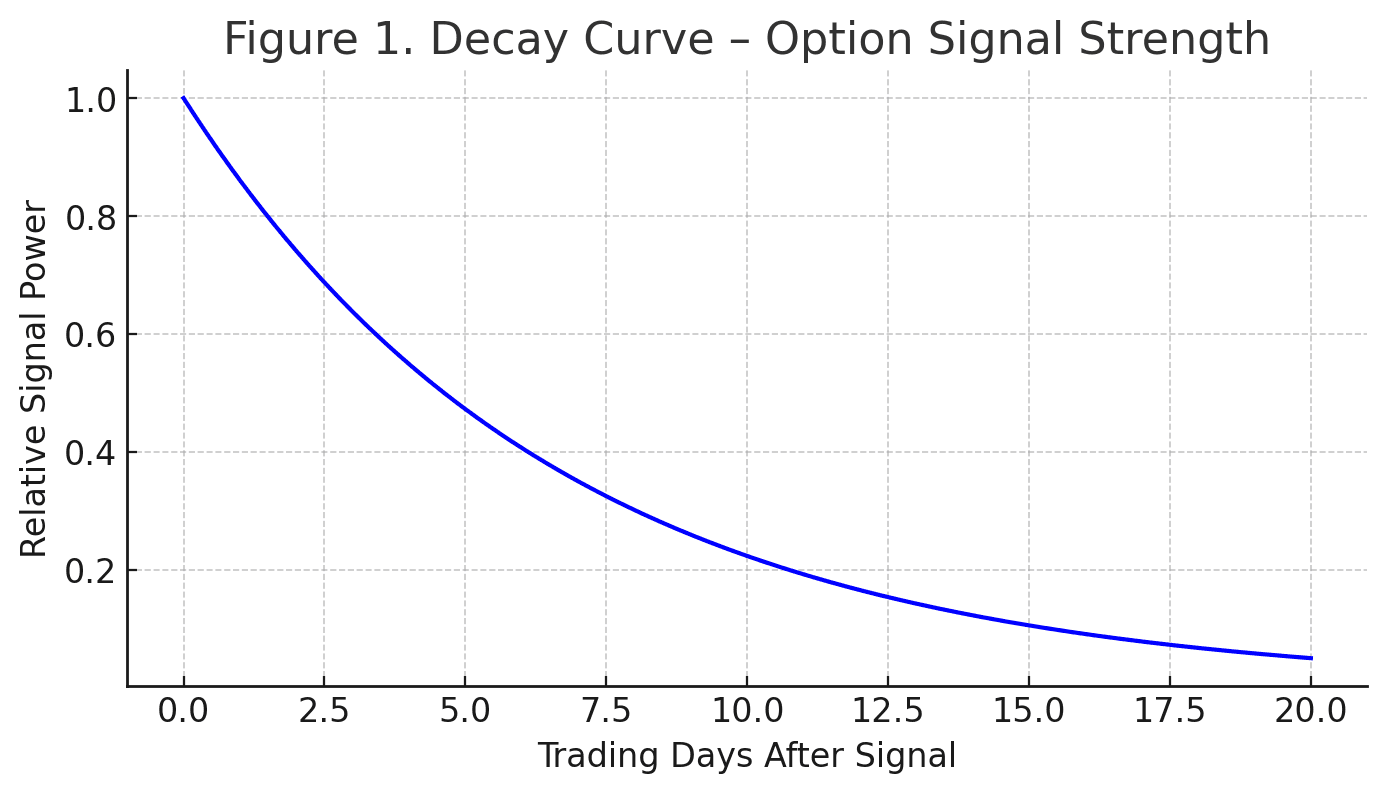

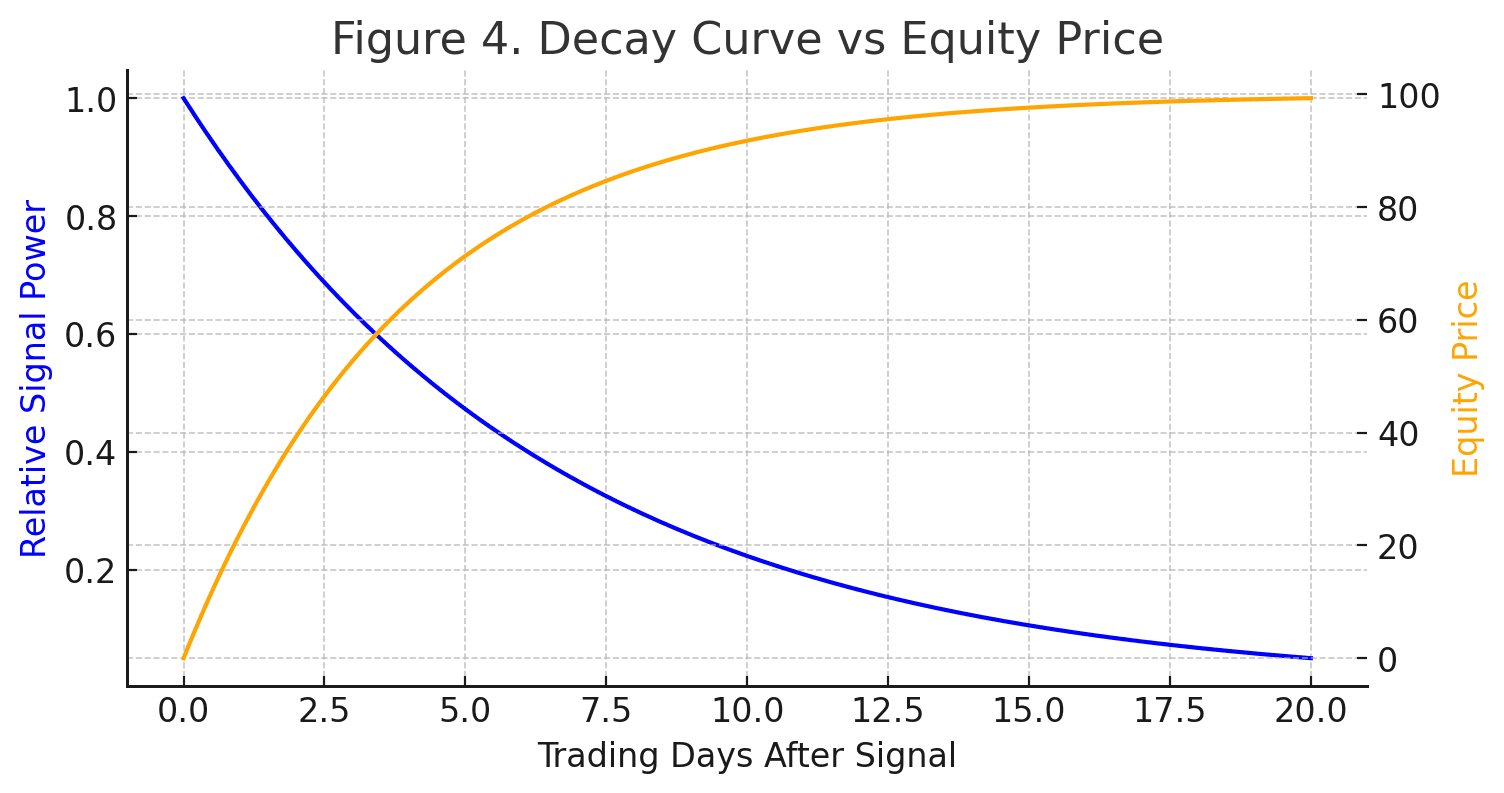

Decay Curve of Options Signals

The Decay Curve

ConvexityIQ turns academic findings into practical edge. Decades of research, show that option markets reveal informed trading before stock prices adjust — but these convexity-driven anomalies decay quickly as information is absorbed.

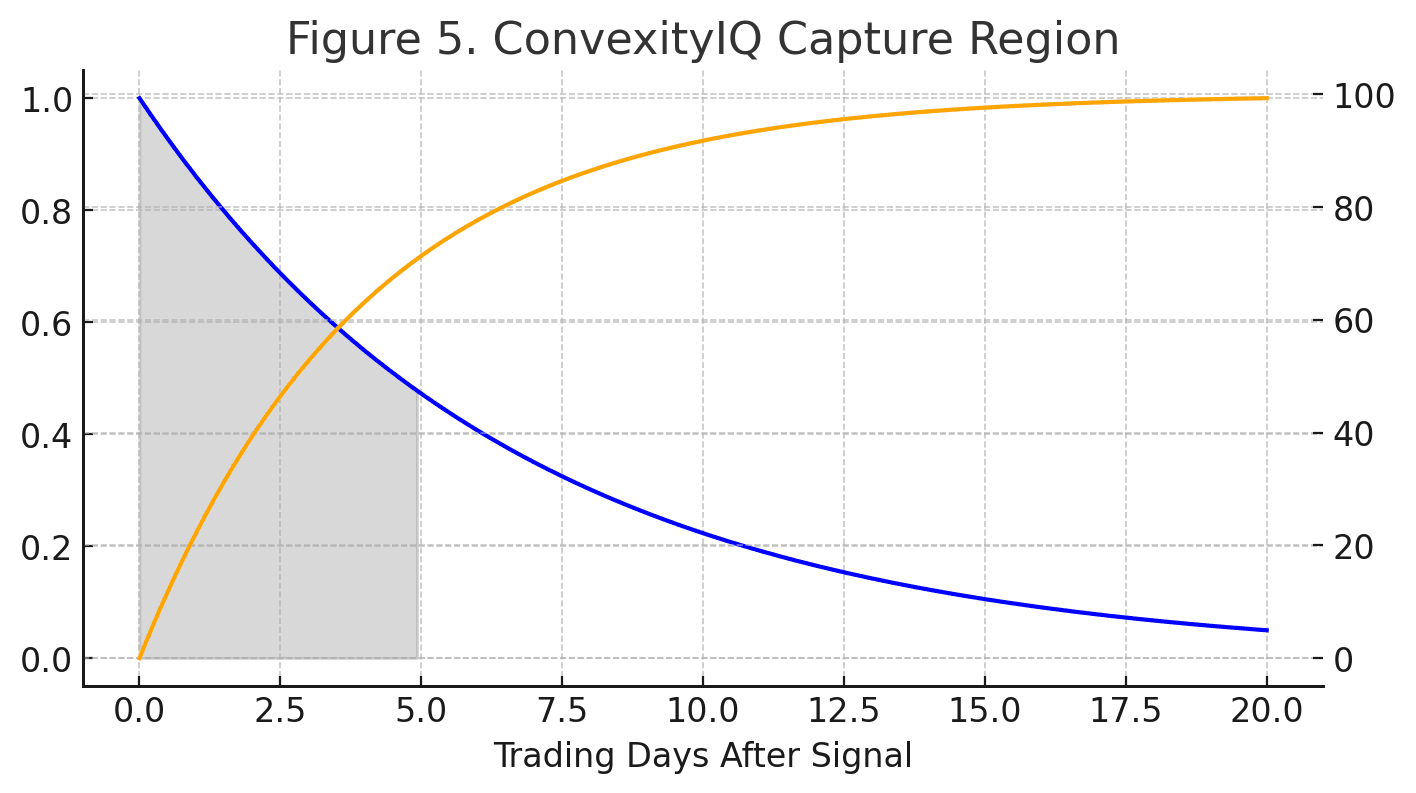

ConvexityIQ captures them systematically. Instead of fragile Greek sensitivities, it measures realized repricing across multiple horizons (ROI-5/10/20), maps them against decay curves, and applies persistence filters to separate durable signals from noise. Survivors emerge as structured signals with defined half-lives.

This creates a convexity-first anomaly engine: identifying measurable mispricings, converting them into buy zones anchored at ROI-5, exploiting the equity lag, and gating entries through macro stress tests (VIX, yields, CDS, BTC dominance, among others).

The result is a pipeline, not just an engine — Discover → Model → Act → Learn — continuously refining in real time. Where academics prove anomalies exist and hedge funds exploit them selectively, ConvexityIQ packages the capability into a systematic, capacity-proof platform that converts curvature into repeatable alpha.

Higher-Order Change

The first level of change measures slope — the rate at which a function rises or falls. The second level measures curvature — how the slope itself is changing. A function that curves upward is considered convex; one that curves downward is concave. These curvature properties determine how a function bends, whether it “holds water” or “spills water,” and where turning points occur.

Convexity in Options

Options have inherently nonlinear payoffs, so their value does not move in a straight line with the underlying asset. They are sensitive not only to immediate price changes but also to changes in curvature. Traditional Greeks (delta, gamma, vega) describe these sensitivities, yet they are static snapshots and often miss how convexity repricing unfolds over time.

Inflection and Discontinuity

Just as mathematical functions can change convexity at turning points or show discontinuities, option markets frequently exhibit sharp shifts in curvature driven by order-flow shocks, catalysts, or liquidity imbalances. These moments of sudden change are the fingerprints of anomalies.

Why ConvexityIQ

Convexity Detection

Multi-window ROI-5/10/20 modeling identifies convexity repricing before it appears in delta or vol surfaces. Converts options-market curvature into a forward indicator of directional risk.

Persistence Validation

Signals pass persistence-gating filters that verify trend continuity across time horizons. False positives decay; durable asymmetries survive. Each carries an α-half-life and confidence score.

Capacity Efficiency

Targets dislocations below institutional capacity thresholds where liquidity is fragmented. Converts structural inefficiencies—ignored by large desks—into executable micro-alpha.

Controlled Deployment

Trade entries routed through predefined scout sleeves (0.5–1.0 %) with exit rails and decay triggers. Ensures disciplined exposure management and low slippage execution.

Appendix A: ConvexityIQ Research Foundation

Academic Basis

A large body of academic research demonstrates that option markets incorporate information before the underlying equity market adjusts.

- Pan & Poteshman (2004) – The Information in Option Volume for Stock Prices: Option trading volume predicts future stock returns. The effect is strongest in smaller-cap names and contracts with high leverage.

- Easley, O’Hara & Srinivas (1998) – Option Volume and Stock Prices: Option flows reflect private information that is not immediately priced into equities.

- Cao, Chen & Griffin (2005) – Informational Content of Option Volume: Options trading contains incremental information about future price movements, even after controlling for stock volume.

- Cremers & Weinbaum (2010) – Deviations from Put-Call Parity: Mispricings in option markets are persistent and linked to future equity returns.

Core implication: Options are not merely derivatives — they are early detectors of informed trading and asymmetric positioning.

Mathematical Foundation

- Higher-order change: First-order change measures slope — the rate of price movement. Second-order change measures curvature — convexity. These curvature dynamics explain whether a function bends upward (convex) or downward (concave).

- Convexity in options: Options have nonlinear payoffs. Their pricing depends not only on immediate changes in the underlying (delta) but also on curvature (gamma). When flows distort implied volatility, the market’s curvature deviates from theoretical models.

- Decay curves: Academic work shows option-driven signals are strongest immediately after they appear and weaken as equities absorb the information. These decay patterns can be quantified, turning transient anomalies into measurable opportunity windows.

Operational Relevance

- Maps realized repricing across multiple horizons (ROI-5/10/20).

- Identifies convexity anomalies — measurable dislocations not explained by standard Greeks.

- Anchors entries at the “buy zone” (early in the decay curve) where persistence is confirmed but alpha remains strong.

- Exploits the equity lag — the delay between option-informed signals and stock price adjustment.

- Embeds macro regime gates (VIX, yields, CDS, BTC dominance) to ensure anomalies are acted on only when contextual probabilities align.

Distinction

Where academics prove these anomalies exist and hedge funds exploit them selectively, ConvexityIQ packages the capability into a convexity-first anomaly pipeline. It bridges:

- Theory → Practice: From higher-order derivatives and convexity analysis to real-time signal detection.

- Evidence → Action: From academic proof of anomalies to systematized, capacity-proof alpha capture.

- Noise → Signal: From raw flows to persistence-gated dislocations with defined half-lives.

Early Insights / Blog

Coming soon: ConvexityIQ Alpha Letters — weekly convexity scan highlights. Subscribe to be notified when it launches.

About ConvexityIQ

ConvexityIQ was founded to bridge the gap between volatility theory and execution — transforming convexity from an academic abstraction into a systematic source of institutional edge.

The platform is an AI-driven intelligence system that translates options market complexity into repeatable convexity signals. It continuously ingests multi-asset, multi-horizon data across ETFs, options, and crypto; models realized repricing behavior; and applies regime-aware risk gates to surface only those asymmetries that persist beyond noise.

At its core is the ConvexityIQ Convexity Engine (CCE) — a proprietary analytics module that detects convexity asymmetries across time windows (5d/10d/20d), quantifies persistence through decay modeling, and routes verified signals into an adaptive execution pipeline. The system continuously learns, self-calibrates, and evolves alongside shifting market microstructure.

ConvexityIQ integrates seamlessly across portfolio contexts — crypto, gold, AI/tech, EM-Asia, liquidity, and defensive rotation — bridging quantitative research with live portfolio execution. It delivers a rotation-aware, globally integrated convexity framework: from volatility telemetry to executable alpha.

Join the Waitlist

Be first to know when private beta opens. We’ll share occasional alpha letters and product updates.

By subscribing, you agree to our Privacy Policy.