Institutional-grade convexity analytics, distilled, democratized, engineered for edge.

“Professional-grade anomaly telemetry — a persistence-aware convexity detector, not a toy UOA feed.”— Institutional Volatility Desk, early beta user

ConvexityIQ transforms raw options telemetry into a persistence-aware market-state instrument. Options surfaces often reprice before equities, embedding asymmetric information in volatility long before it appears in price. Most of that information is fleeting — visible, but not usable.

ConvexityIQ is built to separate what merely appears from what survives. We model convexity decay explicitly, measuring persistence, liquidity, and reinforcement across time — not just instantaneous repricing. Signals are evaluated on whether they remain structurally executable, not whether they were momentarily loud.

ConvexityIQ resolves that survivorship into a standardized market-state readout and a gated execution layer, making convexity persistence comparable across time, instruments, and regimes.

ConvexityIQ does not predict returns or price direction — it measures whether asymmetric opportunity remains structurally exploitable.

The result is convexity intelligence engineered for real decisions: fast validation, disciplined exits, and sizing that adapts to regime. Not a scanner. Not a feed. A durable edge layer designed to function when noise is high and survivability is scarce.

Market-State Framework

ConvexityIQ Market-State Indices

CRI measures regime health. CIX measures survivability once convexity appears.

Market Activity ≠ Usable Convexity

Survivability determines edge.

CRI — Convexity Regime Index

Measures whether convex opportunity is structurally forming, surviving, or failing.

CRI is a persistence-aware market-state readout (not volatility, not price direction). It reflects the health of survivorship across the qualified corridor.

CIX — Convexity Survivability Index

Measures how long convex signals persist once they appear.

CIX compresses when signals decay quickly and expands when convexity survives long enough to execute. It is a durability metric, not a forecast.

Corridor / Survivorship Detection

Separates surface activity from persistence-qualified structures.

Noise → Transition → Carry

Visible, loud, non-survivable. Fails persistence gates.

Early-stage pipeline. May promote or decay without reinforcement.

Persistence-qualified ridge. Survivable structures only.

Market-State Infrastructure

I. Measurement

ConvexityIQ measures the half-life of convexity in trading days. Structures are ranked by survivability — how long reinforcement persists before decay overtakes curvature.

CQ measures multi-window reinforcement across ROI horizons. It distinguishes acceleration, stabilization, and decay to produce a bounded, comparable persistence score.

Signals are adjusted for acceleration bursts, volatility shocks, and migration failure. This prevents transient dislocations from being misclassified as durable convex structures.

II. Regime Architecture

CRI aggregates persistence-qualified structures into a market-state reading. It classifies convex capacity into structural states: Destroying, Degrading, Stable, Building. CRI measures capacity — not direction.

CIX measures median convexity lifespan across the qualified universe. It reflects whether survivability is compressing or extending across the market surface.

ConvexityIQ partitions structures into Noise, Transition, Carry, and Burst. Only persistence-qualified structures enter the corridor, anchoring deployment to reinforcement rather than volatility spikes.

III. Execution Surface

Contract-level outputs are filtered by ROI persistence, liquidity thresholds, and structural reinforcement. Outputs are built for execution, not screenshots.

Trade duration and exposure adapt to CRI state. Aggression is modulated according to structural capacity rather than static heuristics.

Signals are evaluated against volatility, yield dynamics, liquidity conditions, and macro stress indicators prior to qualification.

IV. Integrity

ConvexityIQ measures state and survivability. It does not issue discretionary trade calls or directional forecasts. The system converts convex decay dynamics into comparable regime diagnostics.

Every engine run is timestamped and reproducible from ciq.db. Runs are controlled via explicit public_mode settings and remain free of discretionary overrides.

All artifacts are emitted in stable schema formats, including CRI/CIX indices, corridor composition, and contract selectors — designed for dashboards, licensing, and downstream integration.

V. Deployment

Web console access to regime indices and selector outputs for discretionary desks and portfolio managers.

Canonical JSON artifacts (CRI, CIX, corridor, selectors) for internal systems and model ingestion.

Institutions may run ConvexityIQ privately, retain full audit trails, and control publication settings.

Designed to be licensed like an index and data feed: repeatable, auditable, and comparable across time.

Problem → Solution

Most options “signal” is noise. ConvexityIQ measures what survives.

Options telemetry is rich — but most anomalies are non-executable. ConvexityIQ is built to detect the subset that persists long enough to be traded, and to contextualize that persistence as a market-state.

Noise overwhelms signal

Volume spikes, UOA screenshots, and Greek snapshots don’t tell you what survives. They tell you what happened.

- False positives dominate raw options feeds.

- Most dislocations decay before validation.

- Execution windows are shorter than people think.

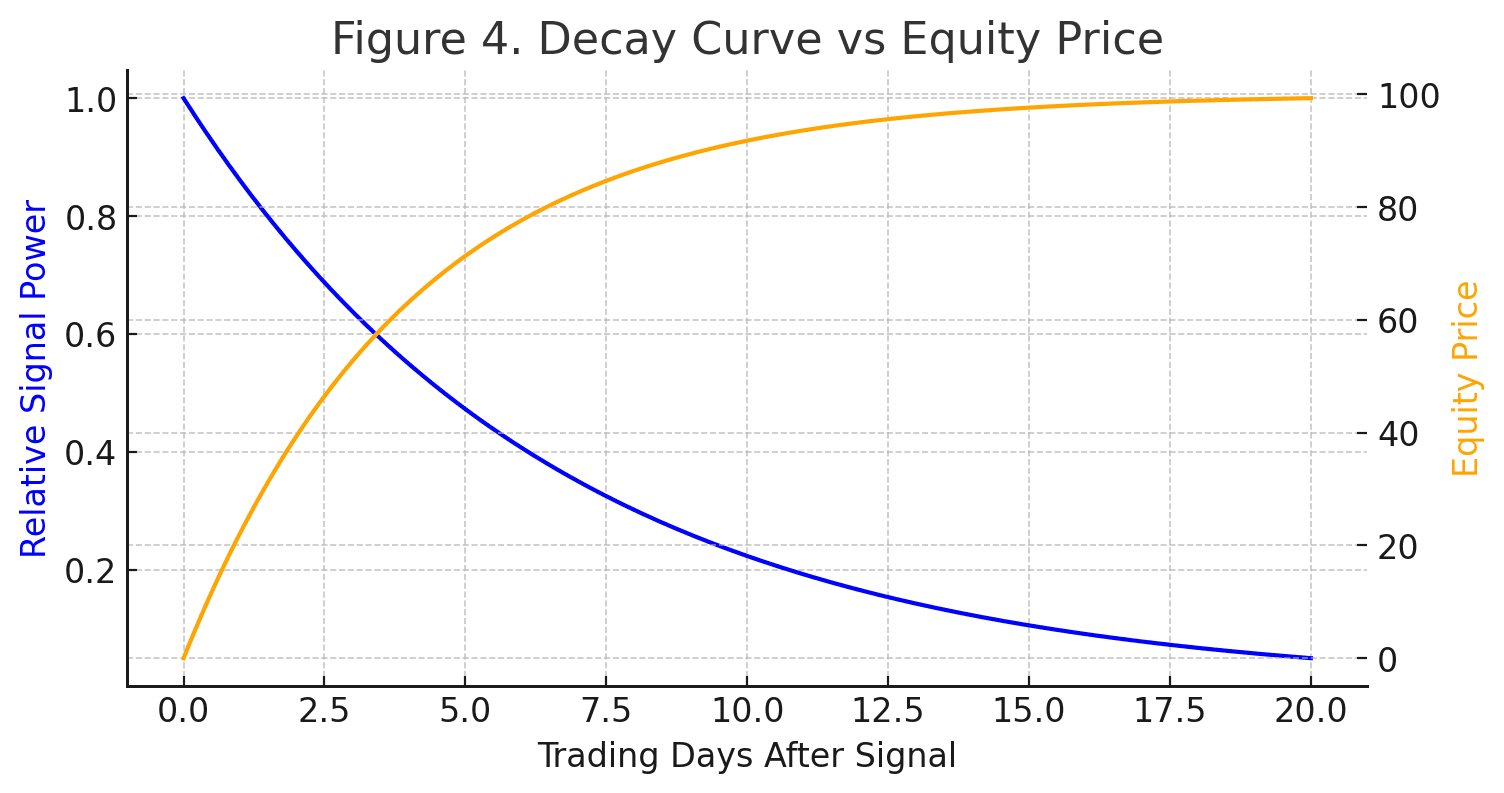

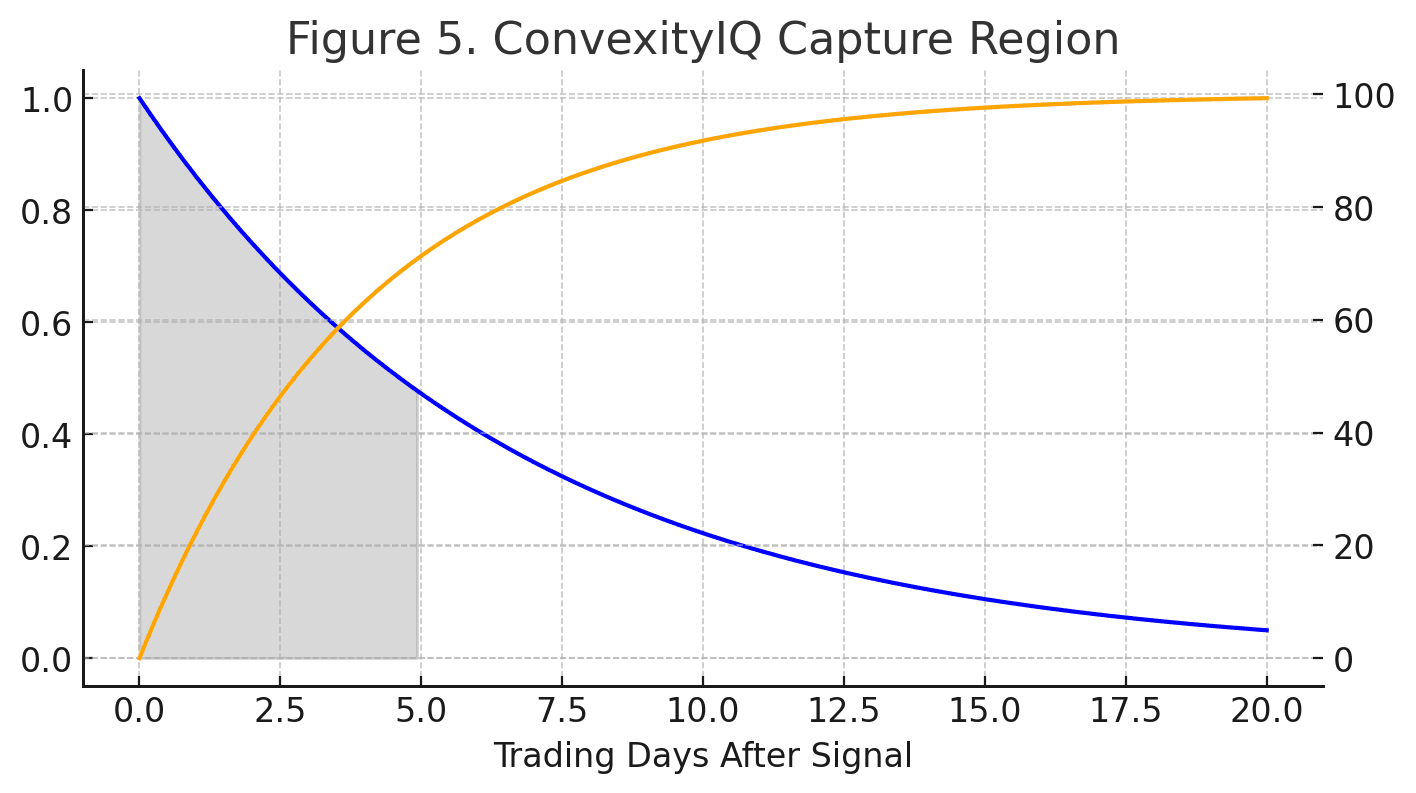

Timing is the edge

The opportunity is not the repricing — it’s capturing it before it decays.

- Signals have a half-life.

- Persistence is measurable.

- Survivorship enables disciplined sizing and realistic execution windows.

We make it tradeable

ConvexityIQ converts raw option repricing into structured, gated, regime-aware outputs.

- Index Console (CIX/CRI): market-state readout.

- Survivor corridor: Transition + Carry structures.

- Selector list: contracts filtered by persistence + liquidity.

How it works

From raw telemetry → survivorship gating → regime resolution.

Options surfaces reprice before equities. ConvexityIQ isolates the dislocations that persist, then resolves them into a regime framework that governs selectivity and execution.

1) Signal intake

High-resolution option telemetry across underlyings, maturities, and strikes.

- Multi-horizon ROI curvature

- Volatility surface dislocation detection

- Liquidity-aware sampling

2) Persistence gating

Survivorship filters remove noise, short-lived bursts, and non-executable artifacts.

- Half-life + decay mapping

- ROI persistence qualification

- CQ gating to reduce false positives

3) Regime resolution

Outputs are contextualized into a market-state framework that governs sizing, duration, and selectivity.

- Noise vs Transition vs Carry classification

- Corridor breadth + survivorship concentration

- CIX/CRI market-state readout

Why ConvexityIQ

Convexity does not fail when markets get noisy. It fails when survivability disappears.

Participation can widen and narratives can multiply — yet exploitable convexity can still contract. ConvexityIQ exists to measure that distinction directly: activity vs durability, direction vs survivability.

What survives is what matters

The edge is not where price moves most — it’s where convexity persists long enough to be executed.

- Separates activity from durability

- Measures persistence instead of direction

- Turns survivorship into structured decision infrastructure

A market instrument, not a thesis

ConvexityIQ outputs are not opinions or forecasts. They are time-stamped market-state measurements derived from options persistence.

- Comparable across time (index-like)

- Auditable (run_key + ciq.db)

- Designed for disciplined validation + exits

The Math

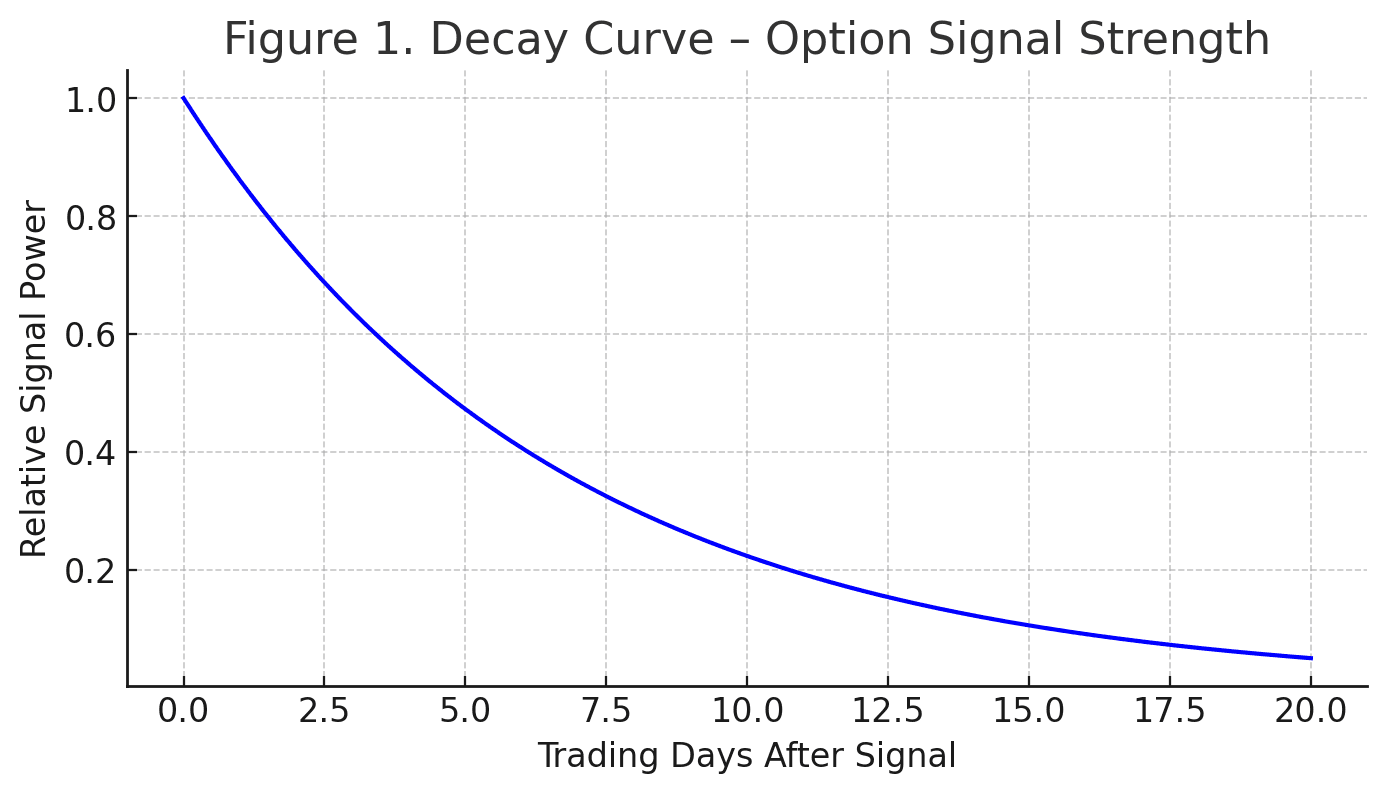

A persistence-aware model of convexity decay.

Convexity dislocations are real — but they decay as markets absorb them. ConvexityIQ formalizes that decay into a survivorship framework.

Core idea

Convexity is only valuable if it persists. We model the decay curve of opportunity and measure half-life.

- Decay curves for signal half-life

- Persistence rank + corridor breadth

- Index aggregation for regime state

Outputs

Two canonical artifacts — one market-state, one execution-layer.

- Index Console (CIX/CRI): VIX-like market capacity

- Survivors + Selector sets: corridor + contracts

- Designed to feed dashboards, reports, and APIs

Decay Curve of Option Signals

Signals decay. Survivorship is the capture region.

ConvexityIQ is engineered to detect and deliver signals inside the window where they can still be executed.

Insights

Convexity intelligence that behaves like an index + feed.

Designed to be recognized as a market instrument: repeatable, auditable, and useful even when the market is noisy.

Regime diagnostics

The index readout tells you what the market supports right now.

- Corridor breadth

- Carry survivorship concentration

- Transition pipeline health

Execution layer

Selectors are filtered for what you can actually trade.

- ROI persistence + liquidity gating

- CQ-qualified contracts

- Timeboxed convexity opportunities

Reporting & audit

Everything is designed for verification and downstream reuse.

- Canonical artifacts (console + JSON)

- run_key & database audit trail

- Compatible with Substack / PDF / dashboards

About

A persistence-aware convexity detector — built as decision infrastructure.

ConvexityIQ is a measurement system: it quantifies survivability, detects corridor compression/expansion, and surfaces what remains executable.

What it is

A market-state instrument derived from option convexity persistence, not a news-driven scanner.

- Measures survivorship, not direction

- Built for systematic selectivity

- Designed for repeatable execution

Who it’s for

Individual traders, small funds, and desks that need institutional-grade convexity insight without institutional bureaucracy.

- Capacity-aware opportunities

- Execution-first design

- Index + feed licensing model

Leadership

Lee Shikoh is a distinguished technology executive, Director of Engineering, and senior SETA Subject Matter Expert with more than three decades of experience architecting and delivering mission-critical, enterprise-scale digital systems. A recognized leader in systems-of-systems engineering, advanced software architecture, and national-level modernization, he has shaped platforms that operate under demanding correctness, resilience, and trust constraints.

Grounded in computer science and mathematics training at Athens State University, Lee began his career building fiduciary-grade institutional financial systems at SunGard, then advanced to industrial-scale engineering at Siemens PLM Software. He later served in senior advisory and technical-authority roles across high-priority DoD modernization initiatives, supporting hardened architectures and decision-support platforms for major defense organizations.

Today, he brings this blend of financial-systems rigor, commercial software discipline, and national-level systems architecture to ConvexityIQ — grounded in a philosophy that structure precedes tradability, survivorship precedes narrative, and systems must measure reality as it is.

Read full biography+

At SunGard, Lee worked on institutional investment-accounting and trust-accounting platforms supporting portfolio valuation, fiduciary reporting, and audit-grade financial processing. These systems demanded deterministic analytics, strict reconciliation controls, and high-integrity data pipelines—constraints familiar to anyone building financial infrastructure where errors are not tolerable and correctness is paramount. This early exposure to fiduciary-grade financial systems established a foundation that continues to inform his approach to quantitative analytics and decision-support architectures.

Lee later expanded into advanced commercial engineering at Siemens PLM Software, where he developed large-scale, high-performance software systems with the precision, mathematical rigor, and scalability expected of one of the world’s foremost engineering organizations. His work there reinforced a deep appreciation for formal system design, reliability engineering, and the challenges of operating complex software platforms at global scale.

Following his commercial engineering tenure, Lee transitioned into senior advisory and technical-authority roles supporting some of the U.S. Department of Defense’s highest-priority modernization initiatives. As a SETA Subject Matter Expert and technical leader at OASYS and Booz Allen Hamilton, he provided enduring strategic guidance and hands-on engineering leadership to the Joint Staff, U.S. Army, U.S. Air Force, and major federal R&D organizations. His work has included modernizing the ORION Global Laydown and Joint Force Capabilities Catalog into a hardened, microservices-based cloud architecture; architecting next-generation theater operational planning and decision-support systems; and contributing to enterprise platforms spanning aviation, logistics, readiness, maintenance, and global force management.

He also played an advisory and engineering role in the U.S. Army’s 5G-to-Next-G initiatives, supporting infrastructure planning and solution analysis for secure, resilient communications across key installations. These efforts required systematic decomposition of monolithic legacy environments, secure integration of authoritative data sources, and multi-agency technical alignment—levels of complexity characteristic only of the DoD’s most consequential programs.

Lee is widely regarded as a transformative architect at the intersection of national defense, quantitative finance, and AI-enabled decision systems. His experience spans C-suite advisory, federal executive support, and hands-on engineering leadership, uniquely positioning him to build platforms where precision, scale, security, and intelligence must converge. ConvexityIQ reflects that lineage: a system designed not for storytelling, but for disciplined measurement and durable decision-making in complex, adversarial environments.

Get access

Join the waitlist.

We’re onboarding a small cohort of early users. If you want first access to the Index Console + Selector feed, drop your email.

Waitlist

Early users get access to the Index Console (CIX/CRI) and contract-level Selector outputs.

Newsletter

Get periodic structural notes on convexity survivorship, corridor dynamics, and regime state.